Gujarat Textile Policy 2024 Benefit Calculator

Estimate Your Benefits

Calculate potential subsidies under Gujarat Textile Policy 2024 based on your project details.

Estimated Benefits

Capital Subsidy

₹0 crore

Interest Subsidy

₹0 crore

Power Savings

₹0

Total Estimated Benefits

₹0 crore

- Capital subsidy capped at 30% of project cost, maximum ₹12 crore

- Interest subsidy is 3% per annum on loans up to ₹100 crore

- Power tariff concession is 25% for first 5 years of operation

- Check eligibility criteria before applying

Key Takeaways

- Policy aims to raise Gujarat’s textile output to 1.5 million tonnes by 2030.

- Capital subsidy up to 30% for new plant‑setups, capped at ₹12 crore.

- Interest‑subsidy of 3% per annum for loans up to ₹100 crore.

- Power tariff concession of 25% for the first five years.

- Single‑window online portal for fast approvals.

When the Gujarat government rolled out the Gujarat Textile Policy 2024 a comprehensive framework aimed at modernising the state's textile sector, offering subsidies, tax relief, and infrastructure support, manufacturers across the state got a new boost. The policy, announced on 15 February 2024, replaces the earlier 2020 scheme and aligns with the national National Textile Policy 2023. Its focus ranges from raw‑material production to high‑value garment exports, with special attention to small‑scale weavers and high‑tech yarn producers.

Why the Policy Matters

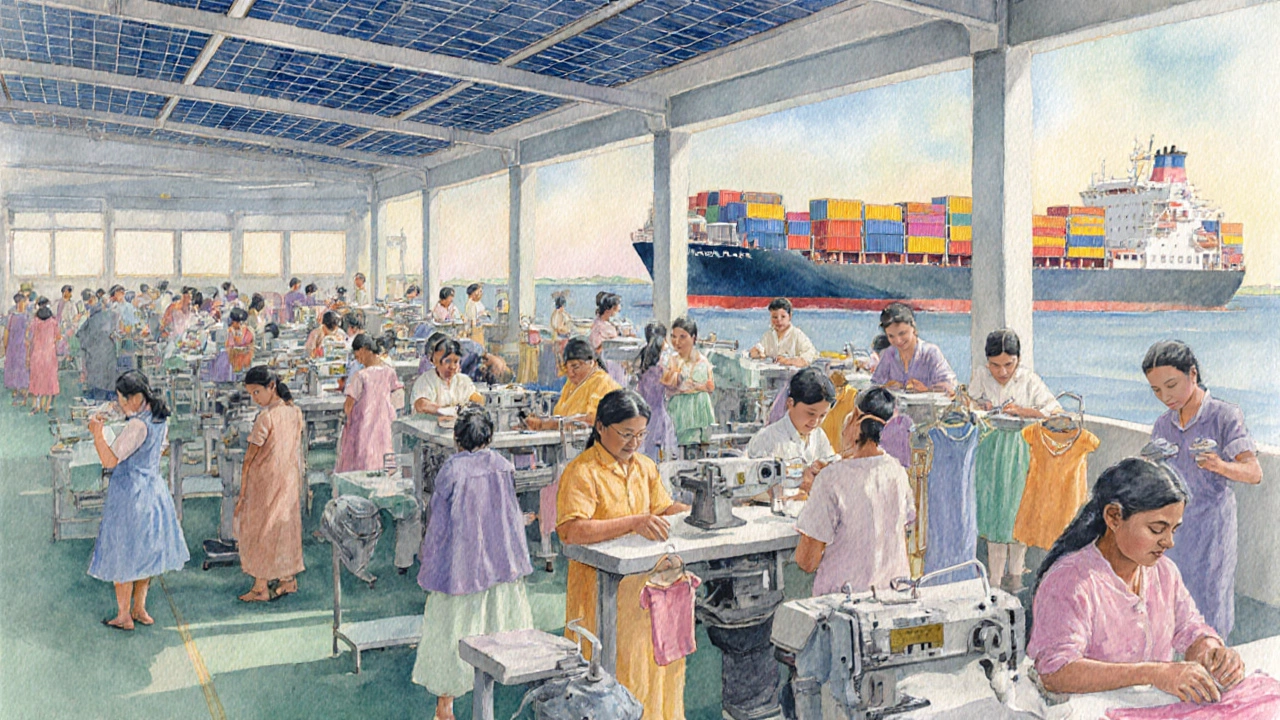

Gujarat contributes about 20% of India’s overall textile output, yet faces challenges like ageing machinery, fragmented supply chains, and skill gaps. By injecting financial incentives and streamlining approvals, the policy targets three measurable goals:

- Increase the state’s textile export share from 12% to 18% by 2030.

- Raise per‑capita employment in the sector from 95 k to 130 k jobs.

- Boost the sector’s contribution to Gujarat’s GDP from 6.5% to 9%.

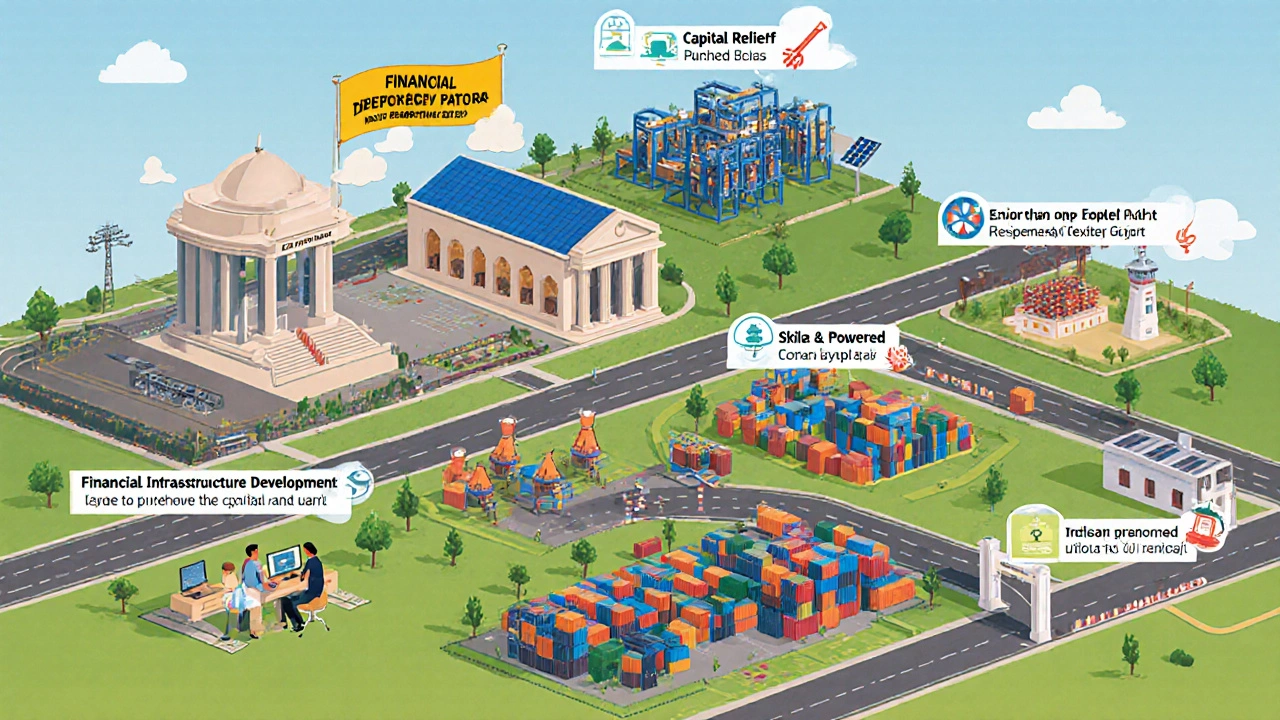

Core Pillars of the Policy

The policy rests on five pillars, each backed by specific incentives:

- Capital Support: Up‑front subsidies for plant expansion, modern loom acquisition, and dye‑house upgrades.

- Financial Relief: Interest‑subsidy on working‑capital loans and loan‑guarantee schemes through GIDC’s finance arm.

- Infrastructure Development: Priority land allocation in Integrated Textile Parks (ITPs) and reduced power tariffs.

- Skill & Technology: Free certification courses via the Gujarat Skill Development Mission and subsidies for adoption of automation.

- Export Promotion: Dedicated export‑focused zones, simplification of customs procedures, and marketing grants.

Eligibility & Major Incentives

Eligibility is defined broadly to include both large manufacturers and cottage‑industry units. Below is a snapshot of the most relevant incentives:

| Incentive | 2024 Policy | 2020 Policy |

|---|---|---|

| Capital Subsidy | Up to 30% (max ₹12 crore) | Up to 20% (max ₹8 crore) |

| Interest Subsidy | 3% per annum on loans ≤ ₹100 crore | 2% per annum on loans ≤ ₹50 crore |

| Power Tariff Concession | 25% reduction for first 5 years | 15% reduction for first 3 years |

| Land Allocation | Priority plots in ITPs, up to 5 acres per unit | Standard allocation, max 2 acres |

| Skill Development Grant | ₹2 lakh per trainee, up to 200 trainees per firm | ₹1 lakh per trainee, up to 100 trainees per firm |

Sector‑Specific Benefits

Traditional Handloom & Weaving: Small‑scale units receive an additional 5% subsidy on loom purchase and free access to the state‑run Design Centre for pattern development.

Yarn & Fabric Production: Companies investing in staple‑fiber or synthetic yarn lines get a fast‑track approval within 30 days, plus a 20% rebate on water‑treatment plants.

Garment Manufacturing: Export‑oriented manufacturers qualify for a marketing grant of up to ₹50 lakh for participation in global trade fairs, and an extra 2% duty exemption on imported accessories.

How to Apply: Step‑by‑Step Guide

- Register on the Gujarat Textile Policy 2024 portal. Create a corporate profile and upload PAN, GST, and factory licence.

- Choose the incentive category (capital, interest, power, or skill) and fill the dedicated application form.

- Attach project proposal, feasibility study, and a self‑declaration of compliance with environmental norms.

- Submit the application. The portal assigns a unique reference number and forwards it to the Gujarat Industrial Development Corporation (GIDC) for initial review.

- If approved, the GIDC issues a sanction letter and disburses the subsidy in three tranches: 40% on commencement, 30% on midway review, and 30% on project completion.

- Maintain a compliance log on the portal; quarterly audits trigger the release of remaining funds.

Implementation Timeline

The government has set a clear roadmap:

- Q2 2024 - Portal launch and first round of approvals.

- Q4 2024 - Completion of 100 Integrated Textile Parks across the state.

- 2025 - Targeted rollout of skill‑training modules to 15 000 workers.

- 2026 - Mid‑term review, with adjustments based on uptake metrics.

What Changed Compared to the 2020 Scheme?

Besides higher subsidy caps, the 2024 policy introduces a digital single‑window system, significantly trimming bureaucratic delays. The emphasis on green technologies-mandatory effluent‑treatment standards and incentives for solar‑powered units-reflects Gujarat’s broader climate agenda.

Common Pitfalls and How to Avoid Them

Many applicants stumble over incomplete documentation. The portal’s checklist feature flags missing items before submission, so review it carefully. Also, note that the power‑tariff concession applies only after the plant has been operational for at least six months; premature claims lead to penalties.

Frequently Asked Questions

Who can apply for the Gujarat Textile Policy 2024?

Both large‑scale manufacturers and small‑scale weavers with a valid GST registration can apply, provided they operate within Gujarat’s jurisdiction.

What is the maximum capital subsidy available?

The policy offers up to 30% of the project cost, capped at ₹12 crore per unit.

How long does the approval process take?

With the digital single‑window system, most applications are cleared within 30 days, provided all documents are in order.

Is there any support for skill development?

Yes, the government provides a grant of ₹2 lakh per trainee for up to 200 trainees per firm, covering courses on modern loom operation, textile design software, and quality control.

Can export‑focused units access additional benefits?

Export‑oriented manufacturers enjoy extra marketing grants, duty exemptions on imported accessories, and priority access to the state’s export promotion zones.