Pharma Company Comparison Tool

Compare Key Metrics

Select what metric you want to compare across the four companies

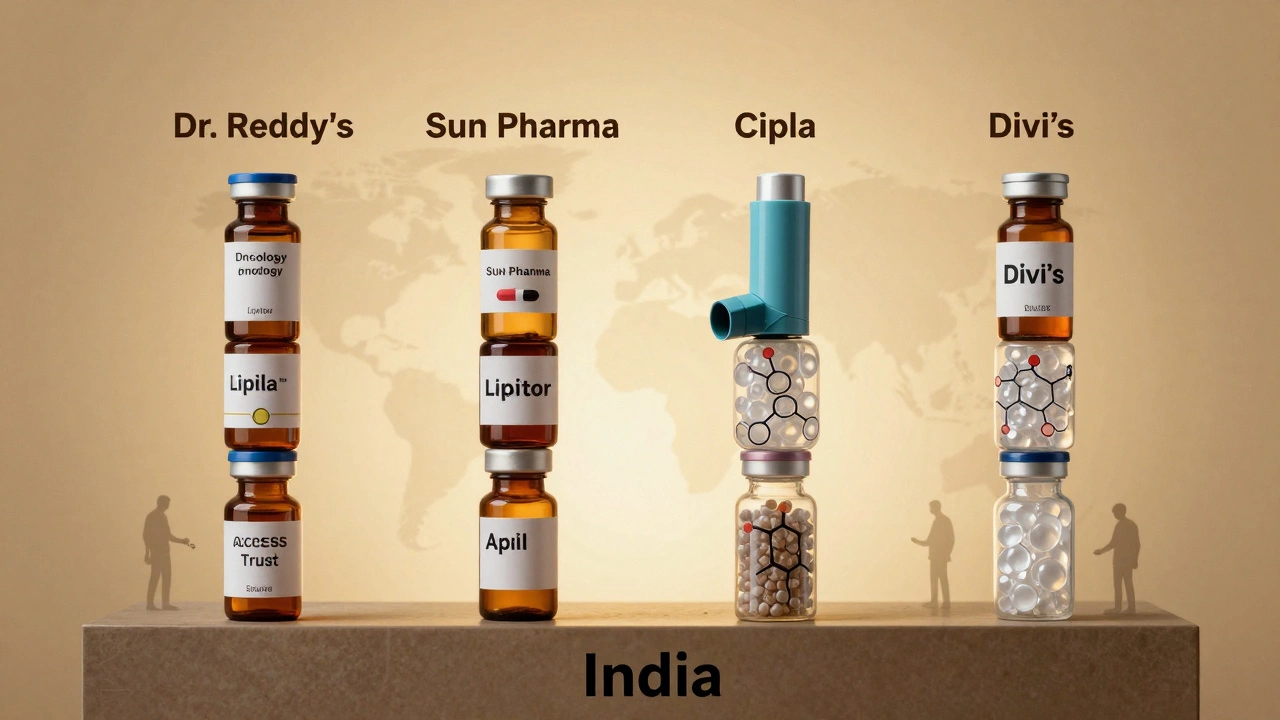

When you think of global medicine, you might picture big names like Pfizer or Novartis. But behind the scenes, India is quietly supplying medicine to over 150 countries. It’s not just about cheap generics - it’s about scale, precision, and reliability. And at the heart of this are four companies that dominate the Indian pharmaceutical landscape. These aren’t just big players. They’re the backbone of global access to affordable drugs.

Dr. Reddy’s Laboratories

Founded in 1984 by Dr. G. V. Prasad’s father, Dr. Reddy’s started as a small lab in Hyderabad. Today, it’s one of the most respected names in generic drugs worldwide. What sets Dr. Reddy’s apart isn’t just volume - it’s innovation. They don’t just copy pills. They reformulate them. For example, their version of the blood thinner clopidogrel works better in patients with certain genetic profiles. That’s not luck. That’s R&D.

The company sells over 1,000 products across 100+ markets. Their U.S. business alone brings in more than $1.5 billion a year. They’re also one of the few Indian pharma firms with a strong presence in complex injectables and oncology drugs. If you’ve ever gotten a generic version of a cancer treatment in Europe or North America, there’s a good chance it came from Dr. Reddy’s.

Sun Pharmaceutical Industries

Sun Pharma is the largest pharmaceutical company in India by market cap and revenue. Started in 1983 by Dilip Shanghvi, it grew from a small trading business into a global powerhouse. How? By buying other companies - smartly. They acquired Ranbaxy in 2014 for $3.2 billion, turning themselves into the world’s fifth-largest generic drugmaker overnight.

Sun Pharma doesn’t just sell pills. They control the entire chain. They make active pharmaceutical ingredients (APIs) in their own plants in Gujarat and Andhra Pradesh. They also have manufacturing sites in the U.S., Brazil, and Israel. Their portfolio includes over 1,500 branded and generic products. If you take a generic version of Lipitor, Prozac, or Viagra in the U.S., there’s a 40% chance it’s made by Sun Pharma.

Cipla

Cipla has a legacy that goes back to 1935. That’s almost a century of making medicine. But what made them legendary wasn’t size - it was ethics. In 2001, Cipla shocked the world by offering HIV/AIDS drugs in Africa for less than $1 a day. At the time, the same drugs cost over $10,000 a year from Western companies. Cipla didn’t just undercut prices - they proved generic drugs could save lives at scale.

Today, Cipla sells over 1,700 products in 80 countries. They’re a top supplier of asthma inhalers, antivirals, and COPD medications. Their Mumbai plant is one of the most advanced in Asia, certified by the FDA, WHO, and MHRA. Even during the pandemic, they kept producing oxygen concentrators and remdesivir at full capacity. Cipla doesn’t chase profits first. They chase access.

Divi’s Laboratories

If you’ve never heard of Divi’s, you’ve still used their products. They don’t make finished pills. They make the raw chemicals inside them - active pharmaceutical ingredients (APIs). That makes them the silent engine behind the other three. Divi’s produces over 300 APIs, including key ingredients for blood thinners, antidepressants, and antibiotics.

They’re vertically integrated. That means they control everything: from chemical synthesis to purification to packaging. Their facility in Telangana is one of the largest API plants in the world. Companies like Pfizer, Merck, and Novartis rely on Divi’s for bulk drug substances. In 2024, Divi’s exported over $1.2 billion worth of APIs. No other Indian company comes close in API volume.

Divi’s is the reason Indian generics are so cheap. They cut out middlemen. They scale production. And they do it with near-perfect quality. The FDA inspects their plants every 18 months - and they’ve passed every single time.

Why These Four? The Real Numbers

India makes 20% of all generic medicines sold globally. But who’s doing the heavy lifting? Here’s the breakdown:

- Dr. Reddy’s: $2.3 billion in annual revenue, 12 manufacturing sites, 50+ countries

- Sun Pharma: $5.8 billion in annual revenue, 25+ manufacturing sites, 100+ countries

- Cipla: $3.1 billion in annual revenue, 18 manufacturing sites, 80+ countries

- Divi’s Laboratories: $1.5 billion in annual revenue, 4 major API plants, supplies 200+ global clients

Together, these four account for nearly 60% of India’s total pharmaceutical exports. They’re not just companies - they’re infrastructure. Without them, the global supply of affordable medicine would collapse.

What Makes Them Different From the Rest?

There are over 3,000 pharma companies in India. So why do these four stand out?

- Regulatory compliance: All four have multiple FDA-approved plants. Most Indian firms have one. These four have five or more.

- Global reach: They sell directly to the U.S., EU, and Japan - markets with the strictest quality controls.

- Vertical integration: They control APIs, formulations, packaging, and distribution. Most Indian firms outsource everything.

- R&D investment: They spend 8-12% of revenue on research. The industry average is under 5%.

- Consistency: Their products pass inspections year after year. No recalls. No scandals.

It’s not about being the biggest. It’s about being the most reliable. In pharma, one bad batch can cost lives. These four have built reputations on never letting that happen.

What’s Next for These Giants?

The next wave isn’t just about generics anymore. It’s about biosimilars - cheaper versions of expensive biologic drugs like Humira and Enbrel. Sun Pharma and Dr. Reddy’s are already launching biosimilars in Europe and the U.S. Cipla is investing heavily in inhalable biologics for asthma. Divi’s is building new plants to make complex peptide APIs.

They’re also moving into specialty drugs - treatments for rare diseases, cancer, and autoimmune disorders. These aren’t cheap. But they’re profitable. And they’re the future.

China is trying to catch up in API production. But Indian companies have one advantage: decades of trust with Western regulators. That’s not something you can buy. It’s earned.

Final Thought: The Real Global Impact

Every time someone in Kenya gets a malaria drug, or a veteran in the U.S. fills a prescription for cholesterol medicine, or a child in Brazil gets antibiotics - there’s a good chance it came from one of these four Indian companies. They don’t advertise on TV. They don’t have celebrity spokespeople. But they’re the reason millions can afford to live.

Their story isn’t about profit. It’s about access. And that’s why they’re not just the big four in India. They’re the big four in global health.

Who are the top 4 pharmaceutical companies in India?

The top four pharmaceutical companies in India are Sun Pharmaceutical Industries, Dr. Reddy’s Laboratories, Cipla, and Divi’s Laboratories. Together, they control nearly 60% of India’s pharmaceutical exports and supply generic drugs, APIs, and biosimilars to over 150 countries. They’re known for regulatory compliance, vertical integration, and consistent quality.

Is Cipla bigger than Dr. Reddy’s?

In terms of revenue, Sun Pharma is the largest, followed by Cipla and then Dr. Reddy’s. Cipla reported $3.1 billion in annual revenue in 2024, while Dr. Reddy’s made $2.3 billion. But size isn’t everything. Dr. Reddy’s leads in complex injectables and oncology, while Cipla dominates in respiratory and HIV drugs. Both are leaders in different segments.

Why is Divi’s considered one of the big four if it doesn’t make finished drugs?

Divi’s doesn’t make pills - it makes the active ingredients inside them. Over 200 global companies, including Pfizer and Novartis, rely on Divi’s for APIs. Without these raw chemicals, finished drugs can’t be made. Divi’s controls 30% of India’s API exports. That makes them essential to the entire supply chain, not just a supplier.

Are these companies FDA-approved?

Yes. All four have multiple manufacturing facilities approved by the U.S. FDA, European EMA, and other global regulators. Sun Pharma has over 15 FDA-approved plants. Dr. Reddy’s and Cipla each have 8-10. Divi’s has four major plants, all FDA-compliant. This is rare - most Indian pharma firms have only one or two approved sites.

Which Indian pharma company exports the most?

Sun Pharmaceutical Industries exports the most, with over $4.8 billion in annual exports in 2024. Dr. Reddy’s follows with $2.1 billion, Cipla with $2.5 billion, and Divi’s with $1.2 billion in API exports. Sun Pharma leads because of its broad portfolio and strong presence in the U.S. market.