Tech Stocks: What They Are, Who Makes Them, and Why India Is Rising Fast

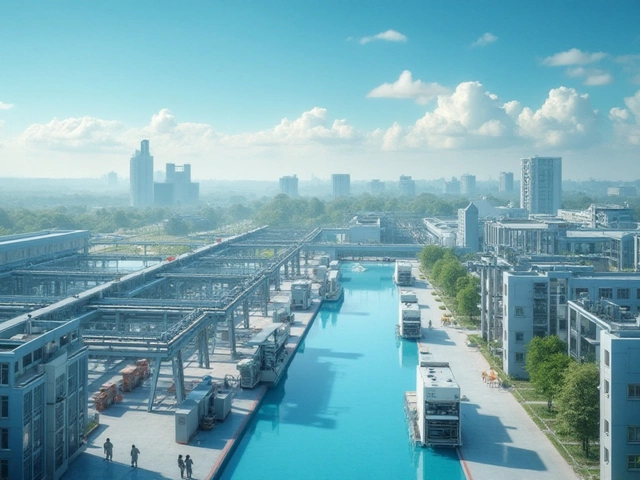

When you buy a tech stock, a share in a company that designs, builds, or supplies technology hardware and systems. Also known as technology equities, it doesn’t just mean you’re betting on software—it means you’re investing in the factories, steel plants, and chemical labs that make the devices work. A tech stock isn’t just a ticker symbol. It’s tied to the electronics manufacturing in India, the growing network of factories producing smartphones, circuit boards, and components across states like Tamil Nadu and Karnataka, and the steel manufacturing, the heavy industry that builds the frames for data centers, solar panels, and electric vehicle chassis that power the digital world.

Look closer and you’ll see how chemical manufacturers India, companies producing high-purity solvents, polymers, and specialty gases used in semiconductor fabrication are quietly enabling the next wave of tech innovation. Without them, even the most advanced chip design can’t be made. Meanwhile, the largest plastic company US, firms like Dow Inc. that supply the casings, insulation, and connectors for every gadget from smartwatches to servers still control a huge chunk of global supply chains—despite rising pressure to shift production closer to end markets.

India isn’t just assembling phones anymore. It’s building the raw materials, the metal frames, the circuit boards, and the packaging that go into them. The same factories making furniture for export are now producing enclosures for smart home devices. The same chemical plants supplying paint and adhesives are now making the compounds needed for lithium-ion batteries. Tech stocks aren’t just about Silicon Valley anymore—they’re about the steel mills in Jamshedpur, the electronics clusters in Pune, and the plastic injection molds in Gujarat. What you own in your portfolio is connected to real, tangible things being made right now. Below, you’ll find real examples of how these industries are changing, who’s leading them, and where the next opportunities are hiding.

TSMC Biggest Investors: Who Owns the Electronics Giant?

TSMC dominates the global semiconductor industry, but who actually pulls the financial strings behind the scenes? This article breaks down the key investors in TSMC and explains why their influence matters. Get a clear view on which companies, funds, or even nations hold the biggest stakes. Plus, you'll see how their investment strategies shape the tech supply chain, especially with India becoming a hotbed for electronics manufacturing. It's a must-read if you want to grasp how the market giants impact what gadgets you use every day.

Electronics ManufacturingLatest Posts

Tags

- manufacturing

- small scale manufacturing

- plastic manufacturing

- India

- plastic pollution

- food processing

- textile industry

- government schemes

- electronics manufacturing

- small business

- steel manufacturing

- startup ideas

- production

- textile manufacturers India

- manufacturing business ideas

- business ideas

- chemical manufacturers India

- electronics manufacturing India

- steel manufacturing plants

- manufacturing business